Ellipse Technologies Files for $75 Million IPO

Ellipse Technologies Files for $75 Million IPO

Most of the IPO financing is intended to help expand the company's sales capabilities.

Ellipse Technologies Inc. wants to go public.

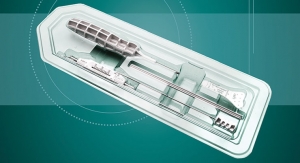

The Aliso Viejo, Calif.-based startup has filed for an initial public offering (IPO) that could bring in as much as $75 million for its orthopedic surgery devices, both of which are already on the market: the Magec-Eos, designed for spinal bracing to curb scoliosis, and the Precice limb-lenthening system for treating limb length discrepancies. The pair help doctors magnetically control, move and adjust devices once they are implanted.

The company said in an Oct. 16 regulatory filing that the addressable market for both the Magec-Eos and the Precice system totaled $1.2 billion in 2014, noting its pipeline includes devices designed to treat trauma, knee osteoarthritis and degenerative spine disease.

“We believe our proprietary Magec technology has the potential to become the standard of care for a wide range of orthopedic conditions,” Ellipse said in the filing.

Ellipse Technologies has treated more than 4,000 patients worldwide with the Magec technology. Magec-Eos was CE marked in 2009 and cleared by the U.S. Food and Drug Administration (FDA) in 2014; Precice was CE marked in 2010 and FDA cleared in 2011. The company also has a pipeline of Magec orthopedic implants that target trauma, knee osteoarthritis and degenerative spine disease.

The technology uses rotational magnetic force from an external remote controller to alter the size, shape, position and alignment of implants through a mechanical, torque-increasing gearing system. It uses cylindrical permanent magnets—two in the controller and one in each implant. Adjustments can be performed either by a doctor or, at times, even by the patient himself based upon a physician prescription.

Ellipse Tech had 78 U.S. independent sales agencies and an additional 30 international independent distributors at June 30. Most of the IPO financing --- $25 million --- is planned to be used to expand its sales capabilities, and $15 million is dedicated to R&D. In addition, the company hopes to use $5 million repay a loan and the remainder going toward "working capital and general corporate purposes." The company also may use some of the funding to acquire or invest in complementary products, technologies or businesses, though there currently are no specific commitments.The startup is heavily backed by Swiss healthcare investor HBM Partners, which holds 29.9 percent of the company pre-IPO through one fund and an additional 12.9 percent through another. Wexford Capital is another major investor, owning 18 percent of the firm.

Watch the video below to learn about the benefits of the Magec system: