Maria Shepherd, President and Founder, Medi-Vantage11.22.16

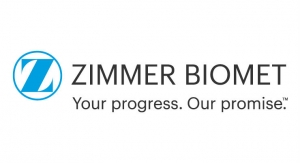

Overall compensation for sports medicine surgeons is reported to be approximately $600,0002 (Chart 1), on par with most other orthopedic subspecialists. Sports medicine surgeons receive incomes substantially higher than their peers in cardiology, oncology, and anesthesiology.3

Why This Is Important

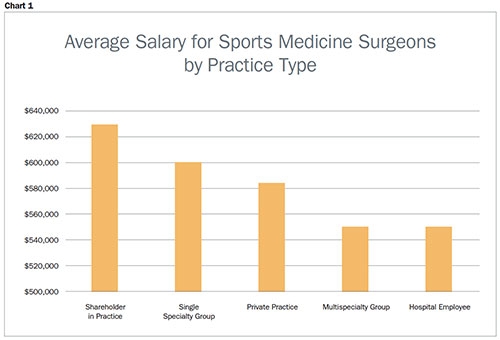

Sports medicine is an important market segment for orthopedic companies. The worldwide market for sports medicine medical devices is expected to increase at a CAGR of 4.4 percent through 2019 when it is expected to reach $8.3 billion.4 By 2024, it is expected to increase to $11.6 billion5 (Chart 2).

Although the trend for hospital employment of surgeons has been pronounced, sports medicine surgeons, like their orthopedic and spine surgeon peers, show a desire to remain independent. According to American Academy of Orthopaedic Surgeons census data, 15 percent of orthopedic surgeons are in single private practice, 35 percent report they are in a private practice orthopedic group, and 10 percent are in a private multispecialty group. Another 15 percent report earning a salary from a hospital.7

Investing in Innovation for Sports Medicine Makes Sense

Sports medicine surgeons enjoy lucrative, growing practices driven by behavioral change in the general population. It is no wonder they choose to remain independent (and maintain control over the devices they use). Investing in medtech for sports medicine surgeons remains one of the few markets where physician choice remains a significant influencer of the type of device used.

References

1 Merritt Hawkins “2014 Review of Physician and Advanced Practitioner Recruiting Incentives” http://bit.ly/snap121601

2 http://bit.ly/snap121602

3 Medscape 2014 Physician Compensation Report http://bit.ly/snap121603

4 http://bit.ly/snap121604

5 http://bit.ly/snap121605

6 2012, U.S. Consumer Product Safety Commission’s National Electronic Injury Surveillance System (NEISS)

7 http://bit.ly/snap121606

8 http://bit.ly/snap121607

Maria Shepherd has more than 20 years of leadership experience in medical device/life-science marketing in small startups and top-tier companies. After her industry career, including her role as vice president of marketing for Oridion Medical where she boosted the company valuation prior to its acquisition by Covidien/Medtronic, director of marketing for Philips Medical and senior management roles at Boston Scientific Corp., she founded Data Decision Group, now re-branded as Medi-Vantage. Medi-Vantage provides marketing and business strategy and innovation research for the medical device industry. The firm quantitatively and qualitatively sizes and segments opportunities, evaluates new technologies, provides marketing services and assesses prospective acquisitions. Shepherd has taught marketing and product development courses, is a member of the Aligo Medtech Investment Committee (www.msbiv.com). She can be reached at 855-343-3100, ext. 102 or at mshepherd@medi-vantage. Visit her website at www.medi-vantage.com.