Michael Barbella, Managing Editor05.23.23

Roy Savage had finally reached his limit.

Although it had taken more than a decade, the constant ache in his right hip had ultimately prevailed, forcing the New Zealand-based investment manager to consult a physician.

Savage expected his doctor to diagnose him with osteoarthritis. It made the most sense, after all: An avid outdoorsman approaching 60, Savage maintained an active lifestyle through various physical endeavors like hiking, mountain climbing, kayaking, swimming, running—virtually anything that kept his body in constant motion.

All admirable yet risky health choices, particularly for more mature joint cartilage.

Naturally, Savage associated his physical fitness regimen with his ailing hip and chalked up the pain to osteoarthritis. The degenerative joint condition seemed to be the only logical cause of the pain.

Logical indeed, but not necessarily conclusive.

X-rays identified Savage’s pain source as a large pelvic tumor on his hip joint. A subsequent biopsy designated the tumor as chondrosarcoma, a type of bone cancer that typically develops within cartilage cells. The second most common form of primary bone cancer in adults, chondrosarcoma is treatable primarily by tumor resection surgery.

“I was quite shocked and quite surprised because I’ve always been fairly healthy,” Savage, in an online posting, said of his unexpected diagnosis. “For example, when I turned 50, we climbed Mt. Kilimanjaro. It was a high-altitude hike, and you need a high level of physical fitness...I’d say I was disappointed, but you’ve got to pick yourself up and carry on.”

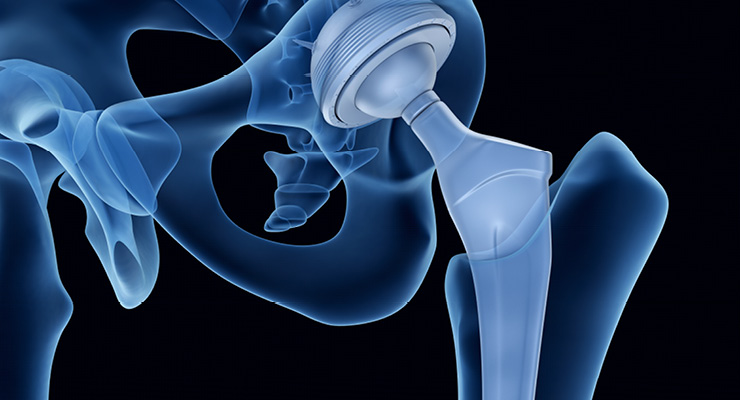

Savage carried on by undergoing a seven-hour procedure to rid his body of the tumor. Doctors first performed a hemipelvectomy with proximal femur resection, then a traditional hip reconstruction using a customized implant from OSSIS, a New Zealand manufacturer of personalized, 3D-printed implants. Currently in the midst of an M&A deal with Zimmer Biomet Holdings, the company’s titanium implants feature antimicrobial silver coating technology and 3D-printed trabecular structures for osteointegration. OSSIS also creates custom cutting guides for preoperative planning.

OSSIS’s customized implant technology enabled Savage’s surgeon to successfully reconstruct his pelvis and restore its biomechanics while also ensuring a stable hip reconstruction. Savage worked hard to recover from his surgery and return to his active lifestyle. He returned to the golf course just four months after his procedure, using only one crutch to move about. Two months later, Savage began paddleboarding again and completed a 3.5-kilometer (two mile) hike in Rangitoto Island, home of New Zealand’s youngest volcano. By his 60th birthday, Savage was scuba diving at the deep water wreck of HMNZS Canterbury in the Bay of Islands.

“Options for this sort of surgery are limited,” Savage’s surgeon Michael Flint, M.D., said, “OSSIS are producing some of the best implants...using innovative technology that can manage these problems.”

Additive manufacturing (AM) has become one of the most effective managers of late, thanks to its design flexibility and penchant for customization. AM—a.k.a., 3D printing—also is better than traditional manufacturing at producing the porous, less weighty structures necessary for biomedical infusion and bone density matching.

To better understand the ways in which 3D printing and other market forces are driving innovation in the global orthopedic implant manufacturing sector, ODT spoke to several industry experts over the last few weeks. They included:

The other trend is the use of 3D printing or additive manufacturing in the build of implants and instruments. The current benefit of this technology is that it can de-constrain the design specs, allowing companies to build in features that were previously not possible or cost-prohibitive due to available manufacturing methods. Companies that are leveraging 3D printing with this in mind are delivering differentiated products. That said, challenges remain for 3D printing. 1) Quality is a challenge as variability in CTQs [critical to quality] from microstructure to geometry are common within the build plate window and from build to build; 2) reliably cleaning the product poses challenges; and 3) it adds steps to the manufacturing process, as all of the conventional methods of manufacturing usually still need to be executed on the product (machining, finishing, cleaning). This often adds lead-time and cost.

Cody Bonk: The industry has steadily been moving toward implants that promote bone growth through porous surfaces and/or bioactive coatings. We are also seeing a significant number of implants being produced via additive manufacturing processes. These technologies do not always deliver a standalone solution that is viable for every scenario; there is, and will continue to be, value in traditional manufacturing methods. There are too many influencing factors to fully encapsulate within a response, but the main driving factors we see affecting these trends are an industry-wide focus on minimally invasive implants and procedures, as well as an increased focus on mitigating recovery time for patients.

Serdar Omur Goren: There are now two main trends in the sector: regulation and reimbursement prices. Pushing on regulation is mainly to kill small companies, leaving less players in competition. The necessities of regulation aren’t cheap, which forces the small companies either to close or reduce product portfolio to decrease the number of technical files they would need to work on and collect clinical data for. Most people in the sector think the regulations are driven by the big players to increase costs for the smaller firms and to bring competition to fair ground. It’s just like the cost difference of running a small boat and a transatlantic. The small company with fewer costs—especially in emerging markets—can offer or accept less reimbursement prices, which helps MOH [manufacturing overhead] in most countries lower the prices periodically.

John Helmuth: What we’re seeing is more growth in the hip side of the business, and what is driving that [growth] is the anterior hip replacement approach. That approach has driven new designs that mostly utilize titanium.

Minimally invasive procedures are also driving implant designs. Cobalt isn’t used as much any more, it may be related to biocompatibility and cost—cobalt is more expensive than titanium. We haven’t seen any new cobalt designs come across for major joint reconstruction in quite a few years.

Product designs are becoming more stringent dimensionally. The traditional methodology for producing parts is manual gaging methods and basic profile verification, where the new designs use coordinate measuring machines and optical scanning methods. There are tighter tolerances that come with all that and more precision is required for those tighter tolerances. We are a forging company that provides net shape forging and precision that really flows down into the process to make a more accurate component and downstream as well to have a more accurate machining operation.

We're also seeing some direct metal laser sintering applications where instead of just forging, you have forgings with additional surfaces grown on them by DMLS processes for bone ingrowth.

In addition to the sets that companies currently have to invest in, which represents their capacity to serve cases, they also need to keep warehouses full of inventory to replenish these sets. It’s not uncommon for companies to carry 12 months of inventory due to the warehouse safety stock and the sets they need to support surgeries. Conservatively, we estimate that companies spend 8% of revenue to just carry the inventory required, and if the time sales reps are involved in the logistics of managing the last mile of inventory is included, this cost can approach 15% of revenue.

Mach’s manufacturing platform, which we call High Velocity Manufacturing, is designed to cost effectively provide two things that position us to assist OEMs with reducing inventory:

Flexible lot sizing, down to single piece manufacturing. We have turned the manufacturing engineering problem inside out. While most companies focus their engineering resources on machine cycle time reduction, ours spent the early years on engineering the setup times out of the process. So we are able to switch from one product to the next with virtually no setup, which when combined with typical machine time optimization, allows for highly economic manufacturing at any quantity.

Very short lead-times. We have engineered our production flows to deliver products within a three-week lead-time. On average, the window of time from the pre-operative planning event to the surgical event for a given case is six weeks. Our lead-time positions us to take the case planning information, build the product(s) needed for that case, and deliver it in time for the surgery. As a result, Mach can provide three tiers of value to OEMs:

Goren: By increasing our prices due to increased costs, which we haven’t changed since a decade. The only thing we try hard to do is to make our customers understand the cost of quality has increased and is still increasing. On the other hand, to stay in the game we play according to the new rules and will try to play as long as we can afford to play.

Helmuth: From the standpoint of our technology roadmap, we’ve built out more value-added services with downstream machining, finishing, and coatings. We are primarily a forging company but we are also bundling that service with more turnkey solutions. We provide outsourcing of coating applications and additive or DMLS solutions as well. Instead of just a straight forging, where a customer will go out and finish a product themselves, we are taking it to a higher precision level and further down the value chain, where the customer wants a total solution. Customers are responding favorably. Given higher OEM overhead rates, it’s become more cost-effective for Tecomet to add more value to the product because it allows the customer to focus on design, branding, marketing, and surgeon-hospital relationships. There are cost advantages to that. At Tecomet, we have a best cost presence in Malaysia and we have technologies and capabilities we can put into the mix for total risk mitigated solutions.

Mach has focused on a handful of these technologies, which enable its High Velocity Manufacturing Platform.

Goren: Any innovation, new manufacturing method, or software has to be validated in Europe before use and once used, the implants and the processes involved should also be validated to prove the result is the same and has no adverse effect to the patient. Therefore, the cost of these validations blocks the new developments.

Helmuth: Some of the technology has to do with automated finishing—utilizing a work cell and cobots where applicable to maximize efficiency. Cobots are collaborative robots that work with a human. You can have a human worker inspecting a part and a cobot loading and unloading a CNC machine. With the labor market having become a challenge, cobots are an example of a technology that keeps humans doing more complex work and automates activities like blasting or repetitive polishing so some of the burden is taken off the labor pool. Simulation software allows you to simulate a cell and predict material flow in the forging process so you can gain insight into process optimization. And there are inspection methods—optic methods, using laser scanning to collect millions of points instead of collecting one point at a time to understand the shape of a point. Simulation is going to predict what you’re going to get out of the process before you start it. If you can more quickly measure your part before you forge it, you can better understand the behavior of the material.

Helmuth: In our business, not so much. There is the digitization of manufacturing with human-machine interaction, which I have already touched on. There are also some challenges with cobots—human-machine interaction where both are working together in a cell. Volume is not as high [in orthopedics] relative to the automotive sector and the cost to deploy fully automated processes compared to the payback can be challenging. Quality requirements are another consideration. If you cleared the ROI hurdle, there is a significant hurdle to clear from a regulatory perspective, and that can be an Implementation challenge with different customers.

We’re also very excited about SITES Medical’s OsteoSync. As previously mentioned, this manufacturing-friendly material is a cost-competitive, high-performance porous material that provides implants with a bony ingrowth feature in the growing market of cementless implants. It’s been proven on Titanium alloy and CoCrMo alloy substrates and offers macro-, micro-, and nano-level features for bone ingrowth.

Bonk: Many of the applications and advancements touched on in previous questions are definitively affecting implant design, such as rapid prototyping via additive manufacturing, improved osseointegration thanks to new bioactive coatings, and advanced AI [artificial intelligence] learning used for improving machining practices.

Goren: 3D printing has been a great help.

Helmuth: Our tool design and the equipment we are using allows us to get more precise in net shape and to achieve tighter tolerances. This is something we’ve focused on over the last several years. These advancements support tighter finished product tolerances.

Bonk: Able Medical Devices has built a strong team of talented individuals, with a wide range of experiences and insights related to manufacturing and development of medical devices, which has allowed us to help our customers reduce costs, improve designs for manufacturability, and adjust materials to reign in lead times. Whether putting in the time to find and procure a hard to source raw material, recommending surface treatments to meet customer needs, or offering alternatives for material selection, Able Medical Devices has the knowledge and connections to better facilitate a quick and satisfactory delivery of high-quality implants and devices.

Goren: Unfortunately with the increased manufacturing costs and delays in supply chain for raw materials as well as semi-finished products, regretfully we haven’t been helping our customers at all. To overcome the delays in supply chain, we have been increasing our stock levels so at least we can meet the delivery expectations of our customers but prices still remain as an issue.

Helmuth: The challenges customers may face around suppliers that have quality issues is of paramount concern. Tecomet has a robust quality management system in place, and it has a reputation for outstanding quality. That is a cornerstone of our company. As it relates to lead time and cost, we’ve made investments to expand our capacity, we’ve instilled lean manufacturing principals to improve throughput and velocity throughout the plant, which impacts cost and quality. Getting products to market quicker with some of the simulation software has been beneficial on the forging side. We have multiple offerings—we have an instrument group and a case/tray group. We do offer customers a one-stop shop, so to speak, all the elements of reconstructive surgery. We offer design services for instruments and DFM services for the implant to make it more cost-effective—how are we going to check this part, how is it going to be dimensioned? We spend a fair amount of time on an advanced quality planning process, working things out up front to help with manufacturing lead time as well. We also help risk mitigate because we have multiple forging sites: We conduct forging services in Sheffield [England]; Wilmington, Mass.; and Lansing, Mich.; so we can risk mitigate supply without the customer having to go to another supplier. That’s another advantage that Tecomet offers. There is also finishing opportunities we offer in Malaysia to help customers meet cost/logistic objectives.

Bonk: The talent shortage within the medical device manufacturing industry has put additional strains on essentially every aspect of medical device businesses. Able Medical Devices has been blessed to have two great sources of intelligent, capable, and driven individuals entering the medical device industry workforce near our Michigan location. We partner with Northern Michigan University and Michigan Technological University, both of which offer a wide range of degrees related to CNC manufacturing and biomedical engineering design. With a close proximity to Able's base of operations, we are able to maintain and develop a mutually beneficial relationship with both universities. We like to say that “We love where we live” and this is true for any prospective students entering the workforce from the nearby educational institutions. This has resulted in Able Medical Devices being fortunate enough to feel less of the strain that others in this industry may be experiencing.

Goren: Being in the transition period to upgrade our CE certifications as well as quality management system to meet the necessities of MDR, we have been receiving more demand from our existing customers and meeting more new customers. We should be increasing our capacity and growing but we can’t because of the talent shortage, which seems not to be resolved in the near future. So we decided to invest more in robotics and automated processes to overcome the absence of workmanship.

Helmuth: Everyone is looking to find people with experience and you can attract talent with competitive benefits, career development in a growth environment where teammates are able to do their best work. We’ve tried to instill partnerships with trade centers and community colleges to get students internships, and we’ve worked with universities to utilize internship programs that help put people on a fast track career-wise—turning opportunities into more of a career than a job. We give them more of an operational view of the business so they can move around in the company and position themselves for leadership roles when they become available. By developing your own people you can help ensure they build a quality product. Training is an ongoing challenge but it's one we feel is a key lever to build retention and a solid team.

The shift of procedures to ASCs will continue to drive pricing pressure. As such, we believe that helping companies save in areas beyond the typical cost per piece metrics will become increasingly important.

Growth is occurring in the cementless segments of implants. We believe having clinically superior ingrowth technologies that are cost competitive are foundational to future viability.

Goren: Steeply to custom-made implants, if these implants somehow could be regulated. Otherwise, as you know they have no class, so therefore no regulations pertain to custom-made implants.

Helmuth: I think the labor market will continue to be tight. From a geopolitical perspective, risk aversion to the overseas market and supply will only put more pressure on the domestic supply. There will be more incorporation of some automated solutions and changes in processes—i.e., incorporating technology to allow the supply base to continue to grow its capacity. I think supply constraints and operational pressure will force the supply base to be more nimble as well.

We have the Baby Boomer generation that is retiring—a large decline in the available labor poor exists-particularly in manufacturing. Before the pandemic we saw an initial step back from the workplace but COVID really accelerated this trend, and I think it will continue.

The pandemic drove social media, and it drove a lot of other technologies like web-based design that potentially interested younger people more than manufacturing, like running a forging press or a CNC machine. The scope of the work that is available has changed and we have to find a way to make manufacturing more interesting. If you can introduce more advanced technology and reduce the menial tasks and further introduce automation—programming and process/factory design—the higher tech end of the manufacturing process might be more attractive to younger generations.

Although it had taken more than a decade, the constant ache in his right hip had ultimately prevailed, forcing the New Zealand-based investment manager to consult a physician.

Savage expected his doctor to diagnose him with osteoarthritis. It made the most sense, after all: An avid outdoorsman approaching 60, Savage maintained an active lifestyle through various physical endeavors like hiking, mountain climbing, kayaking, swimming, running—virtually anything that kept his body in constant motion.

All admirable yet risky health choices, particularly for more mature joint cartilage.

Naturally, Savage associated his physical fitness regimen with his ailing hip and chalked up the pain to osteoarthritis. The degenerative joint condition seemed to be the only logical cause of the pain.

Logical indeed, but not necessarily conclusive.

X-rays identified Savage’s pain source as a large pelvic tumor on his hip joint. A subsequent biopsy designated the tumor as chondrosarcoma, a type of bone cancer that typically develops within cartilage cells. The second most common form of primary bone cancer in adults, chondrosarcoma is treatable primarily by tumor resection surgery.

“I was quite shocked and quite surprised because I’ve always been fairly healthy,” Savage, in an online posting, said of his unexpected diagnosis. “For example, when I turned 50, we climbed Mt. Kilimanjaro. It was a high-altitude hike, and you need a high level of physical fitness...I’d say I was disappointed, but you’ve got to pick yourself up and carry on.”

Savage carried on by undergoing a seven-hour procedure to rid his body of the tumor. Doctors first performed a hemipelvectomy with proximal femur resection, then a traditional hip reconstruction using a customized implant from OSSIS, a New Zealand manufacturer of personalized, 3D-printed implants. Currently in the midst of an M&A deal with Zimmer Biomet Holdings, the company’s titanium implants feature antimicrobial silver coating technology and 3D-printed trabecular structures for osteointegration. OSSIS also creates custom cutting guides for preoperative planning.

OSSIS’s customized implant technology enabled Savage’s surgeon to successfully reconstruct his pelvis and restore its biomechanics while also ensuring a stable hip reconstruction. Savage worked hard to recover from his surgery and return to his active lifestyle. He returned to the golf course just four months after his procedure, using only one crutch to move about. Two months later, Savage began paddleboarding again and completed a 3.5-kilometer (two mile) hike in Rangitoto Island, home of New Zealand’s youngest volcano. By his 60th birthday, Savage was scuba diving at the deep water wreck of HMNZS Canterbury in the Bay of Islands.

“Options for this sort of surgery are limited,” Savage’s surgeon Michael Flint, M.D., said, “OSSIS are producing some of the best implants...using innovative technology that can manage these problems.”

Additive manufacturing (AM) has become one of the most effective managers of late, thanks to its design flexibility and penchant for customization. AM—a.k.a., 3D printing—also is better than traditional manufacturing at producing the porous, less weighty structures necessary for biomedical infusion and bone density matching.

To better understand the ways in which 3D printing and other market forces are driving innovation in the global orthopedic implant manufacturing sector, ODT spoke to several industry experts over the last few weeks. They included:

- Dave Anderson and Steve Rozow, co-founder/marketing lead and co-founder/general manager, respectively, at Mach Medical, an orthopedic device contract manufacturer based in Columbia City, Ind. The company’s proprietary high velocity, single-piece flow manufacturing process enables the firm to build a single implant as efficiently as batch or continuous processing.

- Cody Bonk, sales engineer at Able Medical Devices, a Marquette, Mich.-based medical device manufacturer. Its services range from product design and development to comprehensive finished goods manufacturing. Able Medical Devices is a portfolio organization of The Longyear Company, a privately held Michigan-based asset manager.

- Serdar Omur Goren, vice president at Sayan Orthopaedics Ltd., a division of Turkish medical equipment supplier Sayan Tibbi Aletler Ltd. Founded in 2005, Sayan Orthopaedics manufactures orthopedic, spinal and dental instruments, instrument sets, and implants.

- John Helmuth, general manager at Tecomet Inc., a metal and materials innovator and contract manufacturer that employs almost 2,500 workers and operates more than 21 facilities across 16 campuses.

Michael Barbella: What trends do you see currently shaping the orthopedic implant manufacturing sector? What factors are driving these trends?

Dave Anderson and Steve Rozow: While our industry is still largely monetized by implants, OEMs are pushing the economic frontier by building out a surgical ecosystem with sophisticated preoperative planning tools, robotics that aid surgery for repeatability and accuracy, IoT (Internet of Things) features in implants that can monitor kinematics and performance through the lifecycle of the implant and eventually provide intelligence on improving outcomes. These advancements, done well, have the opportunity to drive improvement in clinical outcomes as well as OR efficiency, which differentiates OEMs’ product portfolios.The other trend is the use of 3D printing or additive manufacturing in the build of implants and instruments. The current benefit of this technology is that it can de-constrain the design specs, allowing companies to build in features that were previously not possible or cost-prohibitive due to available manufacturing methods. Companies that are leveraging 3D printing with this in mind are delivering differentiated products. That said, challenges remain for 3D printing. 1) Quality is a challenge as variability in CTQs [critical to quality] from microstructure to geometry are common within the build plate window and from build to build; 2) reliably cleaning the product poses challenges; and 3) it adds steps to the manufacturing process, as all of the conventional methods of manufacturing usually still need to be executed on the product (machining, finishing, cleaning). This often adds lead-time and cost.

Cody Bonk: The industry has steadily been moving toward implants that promote bone growth through porous surfaces and/or bioactive coatings. We are also seeing a significant number of implants being produced via additive manufacturing processes. These technologies do not always deliver a standalone solution that is viable for every scenario; there is, and will continue to be, value in traditional manufacturing methods. There are too many influencing factors to fully encapsulate within a response, but the main driving factors we see affecting these trends are an industry-wide focus on minimally invasive implants and procedures, as well as an increased focus on mitigating recovery time for patients.

Serdar Omur Goren: There are now two main trends in the sector: regulation and reimbursement prices. Pushing on regulation is mainly to kill small companies, leaving less players in competition. The necessities of regulation aren’t cheap, which forces the small companies either to close or reduce product portfolio to decrease the number of technical files they would need to work on and collect clinical data for. Most people in the sector think the regulations are driven by the big players to increase costs for the smaller firms and to bring competition to fair ground. It’s just like the cost difference of running a small boat and a transatlantic. The small company with fewer costs—especially in emerging markets—can offer or accept less reimbursement prices, which helps MOH [manufacturing overhead] in most countries lower the prices periodically.

John Helmuth: What we’re seeing is more growth in the hip side of the business, and what is driving that [growth] is the anterior hip replacement approach. That approach has driven new designs that mostly utilize titanium.

Minimally invasive procedures are also driving implant designs. Cobalt isn’t used as much any more, it may be related to biocompatibility and cost—cobalt is more expensive than titanium. We haven’t seen any new cobalt designs come across for major joint reconstruction in quite a few years.

Product designs are becoming more stringent dimensionally. The traditional methodology for producing parts is manual gaging methods and basic profile verification, where the new designs use coordinate measuring machines and optical scanning methods. There are tighter tolerances that come with all that and more precision is required for those tighter tolerances. We are a forging company that provides net shape forging and precision that really flows down into the process to make a more accurate component and downstream as well to have a more accurate machining operation.

We're also seeing some direct metal laser sintering applications where instead of just forging, you have forgings with additional surfaces grown on them by DMLS processes for bone ingrowth.

Barbella: How is your company responding to these trends?

Anderson and Rozow: We have configured our manufacturing platform to allow companies to fully realize the value the advancements in the ecosystem can drive. For one, the surgical planning tools will eventually allow companies to more accurately predict what products are needed for a surgery. And rather than carrying large sets into the OR, the target implants, or at least a very abbreviated range of implants, should be delivered for these cases, freeing companies from having to inventory, maintain, and ship (in and out) large sets for each case they are scheduled to support.In addition to the sets that companies currently have to invest in, which represents their capacity to serve cases, they also need to keep warehouses full of inventory to replenish these sets. It’s not uncommon for companies to carry 12 months of inventory due to the warehouse safety stock and the sets they need to support surgeries. Conservatively, we estimate that companies spend 8% of revenue to just carry the inventory required, and if the time sales reps are involved in the logistics of managing the last mile of inventory is included, this cost can approach 15% of revenue.

Mach’s manufacturing platform, which we call High Velocity Manufacturing, is designed to cost effectively provide two things that position us to assist OEMs with reducing inventory:

Flexible lot sizing, down to single piece manufacturing. We have turned the manufacturing engineering problem inside out. While most companies focus their engineering resources on machine cycle time reduction, ours spent the early years on engineering the setup times out of the process. So we are able to switch from one product to the next with virtually no setup, which when combined with typical machine time optimization, allows for highly economic manufacturing at any quantity.

Very short lead-times. We have engineered our production flows to deliver products within a three-week lead-time. On average, the window of time from the pre-operative planning event to the surgical event for a given case is six weeks. Our lead-time positions us to take the case planning information, build the product(s) needed for that case, and deliver it in time for the surgery. As a result, Mach can provide three tiers of value to OEMs:

- Conventional CMO Manufacturing: We can deliver a cost-competitive product at accelerated lead times that minimizes service disruptions to their customers.

- High Velocity Manufacturing: We can deliver cost-competitive products at world-class lead times and flexible lot sizes, which can help to reduce safety stocks by as much as 55%.

- Make-to-Surgical Plan Manufacturing: We can deliver cost-competitive products at world-class lead-times and single piece flow allowing, OEMs to reduce their overall inventory (safety stock and sets) by as much as 85%.

Goren: By increasing our prices due to increased costs, which we haven’t changed since a decade. The only thing we try hard to do is to make our customers understand the cost of quality has increased and is still increasing. On the other hand, to stay in the game we play according to the new rules and will try to play as long as we can afford to play.

Helmuth: From the standpoint of our technology roadmap, we’ve built out more value-added services with downstream machining, finishing, and coatings. We are primarily a forging company but we are also bundling that service with more turnkey solutions. We provide outsourcing of coating applications and additive or DMLS solutions as well. Instead of just a straight forging, where a customer will go out and finish a product themselves, we are taking it to a higher precision level and further down the value chain, where the customer wants a total solution. Customers are responding favorably. Given higher OEM overhead rates, it’s become more cost-effective for Tecomet to add more value to the product because it allows the customer to focus on design, branding, marketing, and surgeon-hospital relationships. There are cost advantages to that. At Tecomet, we have a best cost presence in Malaysia and we have technologies and capabilities we can put into the mix for total risk mitigated solutions.

Barbella: What latest technology, software, or manufacturing innovations have been most impactful on orthopedic implant manufacturing (and why)?

Anderson and Rozow: 3D printing is the hot item on the list as previously mentioned. However, there have been meaningful advancements in cleaning technology, conventional machining, advanced inspection, and product finishing, which continue to keep them competitive from a cost and capability perspective with 3D printing. Additionally, automation of processes is reducing the labor dependency in manufacturing, but in our industry segment we are early in this journey. Finally, eQMS systems, manufacturing execution systems (MES), and product configuration management software (PDM) have come a long way, which makes digitization of the DMR and DHR very practical and cost-effective.Mach has focused on a handful of these technologies, which enable its High Velocity Manufacturing Platform.

- We’ve partnered with SITES Medical to incorporate their high performance, cost-competitive porous material, OsteoSync, into our manufacturing processes. It’s manufacturing-friendly and allows us to provide dimensional repeatability that can’t be matched with other types of porous material. This allows us to build high-performance, cementless implants very cost competitively. It also is a three-dimensional structure that can offer most of the benefits of 3D printing without many of the challenges currently endemic to 3D printing. Additionally, it has a very successful and meaningful clinical history.

- We’ve worked with Siemens and MicroSoft to build out a fully digital DMR and DHR. This reduces the “paperwork” that often is a key driver of manufacturing cost as well as set-up time.

- We’ve leveraged state-of-the-art machine-tool technology that keeps our cycle times competitive and allows us to meet the demanding design specs on the products. Additionally, we’ve incorporated scanning technology that can measure highly reflective surfaces to single digit micron repeatability without having to coat them. This allows us to fully characterize the manufactured parts, enabling economic single piece flow, and providing the customer with a comprehensive and interrogatable DHR of the device.

- Through the work with Siemens and Microsoft, we’ve also been able to substantially automate the translation of design specs into executable manufacturing, which reduces time to market without cutting any quality or regulatory corners. This process is proprietary to Mach, which we call High Velocity Engineering Transfer and captures some of the 3D printing benefits on a conventional manufacturing platform.

Goren: Any innovation, new manufacturing method, or software has to be validated in Europe before use and once used, the implants and the processes involved should also be validated to prove the result is the same and has no adverse effect to the patient. Therefore, the cost of these validations blocks the new developments.

Helmuth: Some of the technology has to do with automated finishing—utilizing a work cell and cobots where applicable to maximize efficiency. Cobots are collaborative robots that work with a human. You can have a human worker inspecting a part and a cobot loading and unloading a CNC machine. With the labor market having become a challenge, cobots are an example of a technology that keeps humans doing more complex work and automates activities like blasting or repetitive polishing so some of the burden is taken off the labor pool. Simulation software allows you to simulate a cell and predict material flow in the forging process so you can gain insight into process optimization. And there are inspection methods—optic methods, using laser scanning to collect millions of points instead of collecting one point at a time to understand the shape of a point. Simulation is going to predict what you’re going to get out of the process before you start it. If you can more quickly measure your part before you forge it, you can better understand the behavior of the material.

Barbella: How has implant manufacturing been impacted by orthopedic implant manufacturing and Industry 4.0?

Anderson and Rozow: We think it’s been limited and spotty, at best, which is why we started Mach Medical. As previously noted, we’ve built our High Velocity Manufacturing and High Velocity Engineering Transfer platforms to help deliver the full value of benefits that the OEMs can realize through their digital ecosystems.Helmuth: In our business, not so much. There is the digitization of manufacturing with human-machine interaction, which I have already touched on. There are also some challenges with cobots—human-machine interaction where both are working together in a cell. Volume is not as high [in orthopedics] relative to the automotive sector and the cost to deploy fully automated processes compared to the payback can be challenging. Quality requirements are another consideration. If you cleared the ROI hurdle, there is a significant hurdle to clear from a regulatory perspective, and that can be an Implementation challenge with different customers.

Barbella: What advancements in manufacturing technologies are affecting implant design?

Anderson and Rozow: Off-the-shelf technologies include 3D printing, scanning technology for the measurement of product, and the advancement of eQMS, PDMs, and MES systems.We’re also very excited about SITES Medical’s OsteoSync. As previously mentioned, this manufacturing-friendly material is a cost-competitive, high-performance porous material that provides implants with a bony ingrowth feature in the growing market of cementless implants. It’s been proven on Titanium alloy and CoCrMo alloy substrates and offers macro-, micro-, and nano-level features for bone ingrowth.

Bonk: Many of the applications and advancements touched on in previous questions are definitively affecting implant design, such as rapid prototyping via additive manufacturing, improved osseointegration thanks to new bioactive coatings, and advanced AI [artificial intelligence] learning used for improving machining practices.

Goren: 3D printing has been a great help.

Helmuth: Our tool design and the equipment we are using allows us to get more precise in net shape and to achieve tighter tolerances. This is something we’ve focused on over the last several years. These advancements support tighter finished product tolerances.

Barbella: How has your company helped customers meet the challenges they face in manufacturing orthopedic implants (lead time, cost, etc.)?

Anderson and Rozow: Cost-competitive pricing, flexible lot sizing, fast manufacturing transfers, short lead-times, and world-class quality systems.Bonk: Able Medical Devices has built a strong team of talented individuals, with a wide range of experiences and insights related to manufacturing and development of medical devices, which has allowed us to help our customers reduce costs, improve designs for manufacturability, and adjust materials to reign in lead times. Whether putting in the time to find and procure a hard to source raw material, recommending surface treatments to meet customer needs, or offering alternatives for material selection, Able Medical Devices has the knowledge and connections to better facilitate a quick and satisfactory delivery of high-quality implants and devices.

Goren: Unfortunately with the increased manufacturing costs and delays in supply chain for raw materials as well as semi-finished products, regretfully we haven’t been helping our customers at all. To overcome the delays in supply chain, we have been increasing our stock levels so at least we can meet the delivery expectations of our customers but prices still remain as an issue.

Helmuth: The challenges customers may face around suppliers that have quality issues is of paramount concern. Tecomet has a robust quality management system in place, and it has a reputation for outstanding quality. That is a cornerstone of our company. As it relates to lead time and cost, we’ve made investments to expand our capacity, we’ve instilled lean manufacturing principals to improve throughput and velocity throughout the plant, which impacts cost and quality. Getting products to market quicker with some of the simulation software has been beneficial on the forging side. We have multiple offerings—we have an instrument group and a case/tray group. We do offer customers a one-stop shop, so to speak, all the elements of reconstructive surgery. We offer design services for instruments and DFM services for the implant to make it more cost-effective—how are we going to check this part, how is it going to be dimensioned? We spend a fair amount of time on an advanced quality planning process, working things out up front to help with manufacturing lead time as well. We also help risk mitigate because we have multiple forging sites: We conduct forging services in Sheffield [England]; Wilmington, Mass.; and Lansing, Mich.; so we can risk mitigate supply without the customer having to go to another supplier. That’s another advantage that Tecomet offers. There is also finishing opportunities we offer in Malaysia to help customers meet cost/logistic objectives.

Barbella: How has the talent shortage impacted orthopedic implant manufacturing? Any solutions on the horizon?

Anderson and Rozow: We have a comprehensive talent acquisition and retention strategy that has been working for us. We’ve had no issues recruiting and retaining talent in the tight labor market and think we are well-positioned for the impacts of the shift in demographics.Bonk: The talent shortage within the medical device manufacturing industry has put additional strains on essentially every aspect of medical device businesses. Able Medical Devices has been blessed to have two great sources of intelligent, capable, and driven individuals entering the medical device industry workforce near our Michigan location. We partner with Northern Michigan University and Michigan Technological University, both of which offer a wide range of degrees related to CNC manufacturing and biomedical engineering design. With a close proximity to Able's base of operations, we are able to maintain and develop a mutually beneficial relationship with both universities. We like to say that “We love where we live” and this is true for any prospective students entering the workforce from the nearby educational institutions. This has resulted in Able Medical Devices being fortunate enough to feel less of the strain that others in this industry may be experiencing.

Goren: Being in the transition period to upgrade our CE certifications as well as quality management system to meet the necessities of MDR, we have been receiving more demand from our existing customers and meeting more new customers. We should be increasing our capacity and growing but we can’t because of the talent shortage, which seems not to be resolved in the near future. So we decided to invest more in robotics and automated processes to overcome the absence of workmanship.

Helmuth: Everyone is looking to find people with experience and you can attract talent with competitive benefits, career development in a growth environment where teammates are able to do their best work. We’ve tried to instill partnerships with trade centers and community colleges to get students internships, and we’ve worked with universities to utilize internship programs that help put people on a fast track career-wise—turning opportunities into more of a career than a job. We give them more of an operational view of the business so they can move around in the company and position themselves for leadership roles when they become available. By developing your own people you can help ensure they build a quality product. Training is an ongoing challenge but it's one we feel is a key lever to build retention and a solid team.

Barbella: How will orthopedic implant manufacturing evolve over the next five years?

Anderson and Rozow: We anticipate the continued build-out of the digital ecosystems that will eventually enable Make-to-Surgical plan. As such, our manufacturing platform will enable companies to realize the full value these systems can bring.The shift of procedures to ASCs will continue to drive pricing pressure. As such, we believe that helping companies save in areas beyond the typical cost per piece metrics will become increasingly important.

Growth is occurring in the cementless segments of implants. We believe having clinically superior ingrowth technologies that are cost competitive are foundational to future viability.

Goren: Steeply to custom-made implants, if these implants somehow could be regulated. Otherwise, as you know they have no class, so therefore no regulations pertain to custom-made implants.

Helmuth: I think the labor market will continue to be tight. From a geopolitical perspective, risk aversion to the overseas market and supply will only put more pressure on the domestic supply. There will be more incorporation of some automated solutions and changes in processes—i.e., incorporating technology to allow the supply base to continue to grow its capacity. I think supply constraints and operational pressure will force the supply base to be more nimble as well.

We have the Baby Boomer generation that is retiring—a large decline in the available labor poor exists-particularly in manufacturing. Before the pandemic we saw an initial step back from the workplace but COVID really accelerated this trend, and I think it will continue.

The pandemic drove social media, and it drove a lot of other technologies like web-based design that potentially interested younger people more than manufacturing, like running a forging press or a CNC machine. The scope of the work that is available has changed and we have to find a way to make manufacturing more interesting. If you can introduce more advanced technology and reduce the menial tasks and further introduce automation—programming and process/factory design—the higher tech end of the manufacturing process might be more attractive to younger generations.