Yulia Sorokina, Research Analyst, iData Research09.13.18

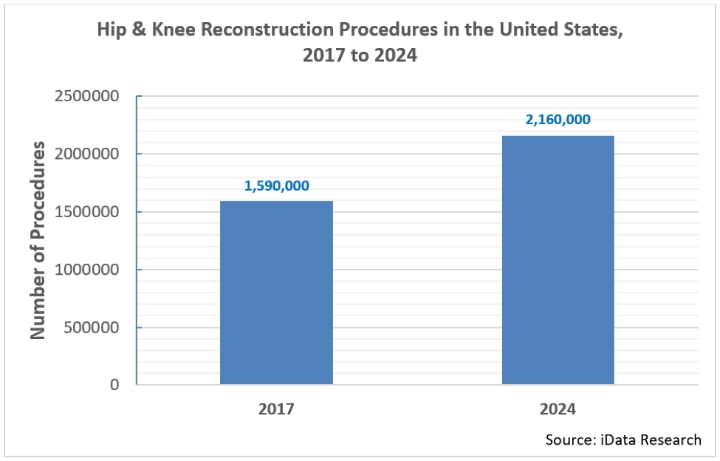

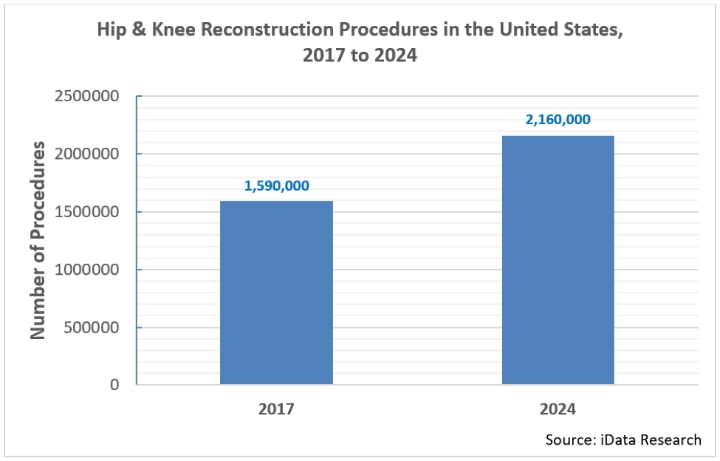

There are over 1.6 million hip and knee reconstruction surgeries performed every year in the United States, and that number is growing at an impressive compound annual growth rate (CAGR) of 4.5 percent. At this rate, by 2024, yearly procedure volumes will exceed 2.1 million1.

Manufacturers in this space are attempting to capitalize on the increasing demand for hip and knee replacement procedures, but strong competition and a shift toward personalized solutions and 3D-printed technologies will likely result in significant disruptions that could have a profound effect on the current market leaders.

The large joint orthopedic device market in the U.S. is characterized by a relatively high degree of commoditization, in addition to aging population trends. In order to differentiate themselves from the competition, companies continue to emphasize the importance of innovation by heavily investing in research and development activities and by completing strategic acquisitions of various high-tech startups. As indicated in iData Research’s latest market analysis, the gap between the market shares of the top market players has been narrowing over the last few years, and competition in this lucrative market will continue to intensify.

The Future Is Personalized Solutions

Customized treatment options in the medical device industry have become a more prominent trend in recent years, and demand for custom large joint solutions has been growing accordingly. Currently, there are only a limited number of true custom implant options available in the U.S. Conformis offers a comprehensive portfolio of custom implants, which includes solutions for both partial and total knee replacements. In March 2016, Conformis expanded their custom implant portfolio by launching the iTotal PS Custom Knee System. Their previous product, the iTotal CR System, was introduced in May 2011. Their technology relies on creating custom implants based on the CT scan of a patient’s joint, which is then transferred to a 3D model and manufactured with the assistance of 3D printing technology.

Although they offer a number of clinical benefits, the adoption of custom joint implants has been constrained by their prohibitively high cost. While some experts believe increased adoption of 3D printing technology would make the creation of custom implants more cost-effective in the long run, the current large joint device players are focusing more on personalized instrumentation, as well as enhancing the qualities of off-the-shelf implants. Personalized instruments are meant to improve the precision of off-the-shelf implant positioning and alignment in a way tailored to the patient’s individual anatomy, an improvement in application while maintaining a lower cost compared to true custom implants.

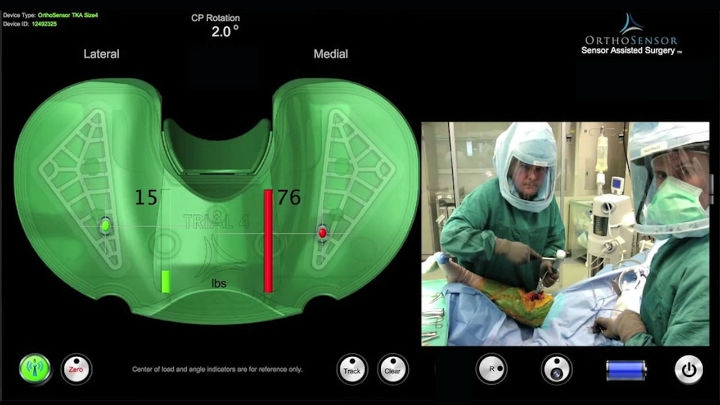

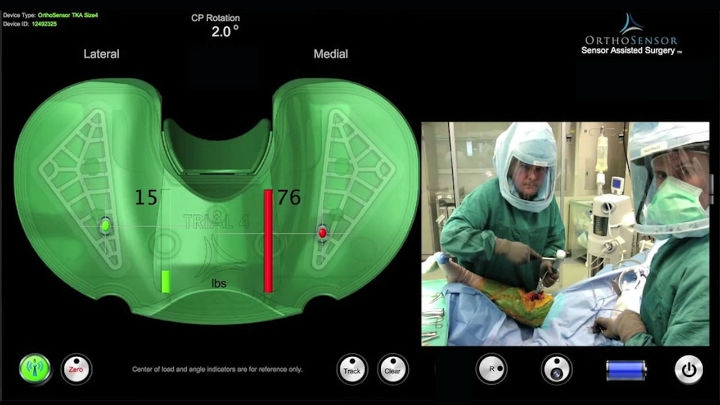

One of the promising developments in the area of personalized solutions is intelligent instrumentation, for example, disposable sensors. A disposable sensor, such as the VERASENSE from OrthoSensor, creates real-time visualization and quantification of the patient’s individual parameters during knee replacement surgery.

VERASENSE enables surgeons to quantify ligament balance by giving them real-time, evidence-based data during primary and revision total knee arthroplasty. Image courtesy of OrthoSensor.

Another development attracting particularly strong interest in the orthopedic community is the use of robotic-assisted surgery in the large joint market. The market penetration of this technology is increasing rapidly. Robotic applications assist the surgeon in the process of surgery planning, as well as in bone preparation and implant placement during the procedure.

A cutting block, also known as a cutting guide, is an example of a mechanical personalized instrument that is created based on the patient’s MRI or CT scan. Meant to be used by the surgeon to shape the knee for the implant, cutting blocks don’t offer computerized assistance during the arthroplasty procedure, unlike the other solutions discussed previously. While cutting blocks were highly acclaimed when they first appeared in the market, their added benefit to clinical outcomes didn’t fully meet the expectations of the orthopedic community2,3. According to iData Research analysis, the market for cutting blocks is expected to decline over the next decade, being gradually displaced by emerging innovative solutions.

3D-Printing, Still New But Gaining Acceptance

Many orthopedic companies have chosen to invest in cutting-edge 3D printing or additive-manufacturing technology. The 3D-printed materials allow the enrichment of off-the-shelf implants with qualities that promise better clinical outcomes than conventional materials. There have been some key additively manufactured off-the-shelf implants released in the market over the last few years. In March 2016, Smith & Nephew introduced their REDAPT Acetabular Fully Porous Cup with CONCELOC Technology, the company’s first 3D-printed titanium hip implant. The fully porous structure of this 3D-printed device, which imitates the structure of the bone, is designed to support the bone ingrowth and, as a result, allows for better fixation of the implant.

Following Smith & Nephew, Stryker launched their first 3D-printed hip implant, the Trident II Acetabular System, in March 2018. The implant mimics the bone’s structure and promises numerous clinical benefits, such as improved joint stability and range of motion. Before this launch, Stryker’s knee implant portfolio included a number of 3D-printed components, such as patellas and tibial baseplates.

Trident II Acetabular System. Image courtesy of Stryker.

The orthopedic community expects to see a number of upcoming 3D-manufactured implant launches within the next few years as companies continue to invest in this cutting-edge technology. Stryker first started exploring 3D-printing back in 2001, but the company now owns the AMagine Institute, an additive manufacturing innovation center in Ireland. In April 2017, DePuy Synthes acquired 3D-printing technology from Tissue Regeneration Systems. 3D-printed implants offer alternative methods for implant fixation and, therefore, the increased adoption of 3D-printing technology will accelerate the shift from cemented arthroplasty devices to cementless versions.

Shift Towards Ambulatory Surgery Centers (ASCs) Might Combat Cost Implications

While the application of new technologies promises a number of clinical advantages, the added cost of their usage hinders quick adoption, since healthcare providers continue to push for lower pricing on medical devices. There are several studies currently being conducted to assess the cost-benefit ratio of these solutions and the results will greatly affect the future development of the large joint market as a whole. For example, one of the initial studies conducted by W. Moschetti et al. has demonstrated the cost-effectiveness of robotic-assisted unicompartmental knee arthroplasty when the number of cases exceeds 94 per year4.

The growing importance of ambulatory surgical centers (ASCs) in the large joint device market may catalyze the adoption of cutting-edge orthopedic solutions in the United States. The number of outpatient hip and knee arthroplasties is expected to grow rapidly over the next decade, outpacing the growth of inpatient large joints procedures5. As procedure efficiency and shorter recovery times are crucial in outpatient settings, ASCs tend to adopt the latest technological developments faster than hospitals.

Overall, the intensifying competition in the large joint replacement device market in the U.S. puts pressure on the market players to follow the latest market developments, in order to secure and grow their market share. While most companies may be optimistic for individual growth, given the increasing volume of hip and knee replacement procedures, the companies able to quickly respond to the changing market environment will further strengthen their market position.

References

1 U.S. Market Report Suite for Orthopedic Large Joint Devices – 2018. iData Research Inc.

2 U.S. Market Report Suite for Orthopedic Large Joint Devices – 2015. iData Research Inc.

3 Chughtai M., Khlopas, Davidson I.U., Yakubek G.A., Stearns K.L., Mont M.A. (2017). Custom Cutting Guides in Total Knee Arthroplasty. Annals of Translational Medicine, 5(10): 216. Doi: 10.21037/atm.2017.02.20

4 Moschetti W.E., Konopka J.F., Rubash H.E., Genuario J.W. (2016). Can Robot-Assisted Unicompartmental Knee Arthroplasty Be Cost-Effective? A Markov Decision Analysis. The Journal of Arthroplasty, 31(4):759-65. Doi: 10.1016/j.arth.2015.10.018

5 Dyrda L. (2017). 16 Things to Know about Outpatient Total Joint Replacements and ASCs. Becker's ASC Review.

Yulia Sorokina is a research analyst at iData Research, an international market research and consulting firm focused on providing market intelligence for the medical device, dental and pharmaceutical industries. She was the lead researcher on the latest research covering the Large Joint Replacement Devices Market in the United States and has a history of other research projects with iData in Orthopedics.

Manufacturers in this space are attempting to capitalize on the increasing demand for hip and knee replacement procedures, but strong competition and a shift toward personalized solutions and 3D-printed technologies will likely result in significant disruptions that could have a profound effect on the current market leaders.

The large joint orthopedic device market in the U.S. is characterized by a relatively high degree of commoditization, in addition to aging population trends. In order to differentiate themselves from the competition, companies continue to emphasize the importance of innovation by heavily investing in research and development activities and by completing strategic acquisitions of various high-tech startups. As indicated in iData Research’s latest market analysis, the gap between the market shares of the top market players has been narrowing over the last few years, and competition in this lucrative market will continue to intensify.

The Future Is Personalized Solutions

Customized treatment options in the medical device industry have become a more prominent trend in recent years, and demand for custom large joint solutions has been growing accordingly. Currently, there are only a limited number of true custom implant options available in the U.S. Conformis offers a comprehensive portfolio of custom implants, which includes solutions for both partial and total knee replacements. In March 2016, Conformis expanded their custom implant portfolio by launching the iTotal PS Custom Knee System. Their previous product, the iTotal CR System, was introduced in May 2011. Their technology relies on creating custom implants based on the CT scan of a patient’s joint, which is then transferred to a 3D model and manufactured with the assistance of 3D printing technology.

Although they offer a number of clinical benefits, the adoption of custom joint implants has been constrained by their prohibitively high cost. While some experts believe increased adoption of 3D printing technology would make the creation of custom implants more cost-effective in the long run, the current large joint device players are focusing more on personalized instrumentation, as well as enhancing the qualities of off-the-shelf implants. Personalized instruments are meant to improve the precision of off-the-shelf implant positioning and alignment in a way tailored to the patient’s individual anatomy, an improvement in application while maintaining a lower cost compared to true custom implants.

One of the promising developments in the area of personalized solutions is intelligent instrumentation, for example, disposable sensors. A disposable sensor, such as the VERASENSE from OrthoSensor, creates real-time visualization and quantification of the patient’s individual parameters during knee replacement surgery.

VERASENSE enables surgeons to quantify ligament balance by giving them real-time, evidence-based data during primary and revision total knee arthroplasty. Image courtesy of OrthoSensor.

Another development attracting particularly strong interest in the orthopedic community is the use of robotic-assisted surgery in the large joint market. The market penetration of this technology is increasing rapidly. Robotic applications assist the surgeon in the process of surgery planning, as well as in bone preparation and implant placement during the procedure.

A cutting block, also known as a cutting guide, is an example of a mechanical personalized instrument that is created based on the patient’s MRI or CT scan. Meant to be used by the surgeon to shape the knee for the implant, cutting blocks don’t offer computerized assistance during the arthroplasty procedure, unlike the other solutions discussed previously. While cutting blocks were highly acclaimed when they first appeared in the market, their added benefit to clinical outcomes didn’t fully meet the expectations of the orthopedic community2,3. According to iData Research analysis, the market for cutting blocks is expected to decline over the next decade, being gradually displaced by emerging innovative solutions.

3D-Printing, Still New But Gaining Acceptance

Many orthopedic companies have chosen to invest in cutting-edge 3D printing or additive-manufacturing technology. The 3D-printed materials allow the enrichment of off-the-shelf implants with qualities that promise better clinical outcomes than conventional materials. There have been some key additively manufactured off-the-shelf implants released in the market over the last few years. In March 2016, Smith & Nephew introduced their REDAPT Acetabular Fully Porous Cup with CONCELOC Technology, the company’s first 3D-printed titanium hip implant. The fully porous structure of this 3D-printed device, which imitates the structure of the bone, is designed to support the bone ingrowth and, as a result, allows for better fixation of the implant.

Following Smith & Nephew, Stryker launched their first 3D-printed hip implant, the Trident II Acetabular System, in March 2018. The implant mimics the bone’s structure and promises numerous clinical benefits, such as improved joint stability and range of motion. Before this launch, Stryker’s knee implant portfolio included a number of 3D-printed components, such as patellas and tibial baseplates.

Trident II Acetabular System. Image courtesy of Stryker.

The orthopedic community expects to see a number of upcoming 3D-manufactured implant launches within the next few years as companies continue to invest in this cutting-edge technology. Stryker first started exploring 3D-printing back in 2001, but the company now owns the AMagine Institute, an additive manufacturing innovation center in Ireland. In April 2017, DePuy Synthes acquired 3D-printing technology from Tissue Regeneration Systems. 3D-printed implants offer alternative methods for implant fixation and, therefore, the increased adoption of 3D-printing technology will accelerate the shift from cemented arthroplasty devices to cementless versions.

Shift Towards Ambulatory Surgery Centers (ASCs) Might Combat Cost Implications

While the application of new technologies promises a number of clinical advantages, the added cost of their usage hinders quick adoption, since healthcare providers continue to push for lower pricing on medical devices. There are several studies currently being conducted to assess the cost-benefit ratio of these solutions and the results will greatly affect the future development of the large joint market as a whole. For example, one of the initial studies conducted by W. Moschetti et al. has demonstrated the cost-effectiveness of robotic-assisted unicompartmental knee arthroplasty when the number of cases exceeds 94 per year4.

The growing importance of ambulatory surgical centers (ASCs) in the large joint device market may catalyze the adoption of cutting-edge orthopedic solutions in the United States. The number of outpatient hip and knee arthroplasties is expected to grow rapidly over the next decade, outpacing the growth of inpatient large joints procedures5. As procedure efficiency and shorter recovery times are crucial in outpatient settings, ASCs tend to adopt the latest technological developments faster than hospitals.

Overall, the intensifying competition in the large joint replacement device market in the U.S. puts pressure on the market players to follow the latest market developments, in order to secure and grow their market share. While most companies may be optimistic for individual growth, given the increasing volume of hip and knee replacement procedures, the companies able to quickly respond to the changing market environment will further strengthen their market position.

References

1 U.S. Market Report Suite for Orthopedic Large Joint Devices – 2018. iData Research Inc.

2 U.S. Market Report Suite for Orthopedic Large Joint Devices – 2015. iData Research Inc.

3 Chughtai M., Khlopas, Davidson I.U., Yakubek G.A., Stearns K.L., Mont M.A. (2017). Custom Cutting Guides in Total Knee Arthroplasty. Annals of Translational Medicine, 5(10): 216. Doi: 10.21037/atm.2017.02.20

4 Moschetti W.E., Konopka J.F., Rubash H.E., Genuario J.W. (2016). Can Robot-Assisted Unicompartmental Knee Arthroplasty Be Cost-Effective? A Markov Decision Analysis. The Journal of Arthroplasty, 31(4):759-65. Doi: 10.1016/j.arth.2015.10.018

5 Dyrda L. (2017). 16 Things to Know about Outpatient Total Joint Replacements and ASCs. Becker's ASC Review.

Yulia Sorokina is a research analyst at iData Research, an international market research and consulting firm focused on providing market intelligence for the medical device, dental and pharmaceutical industries. She was the lead researcher on the latest research covering the Large Joint Replacement Devices Market in the United States and has a history of other research projects with iData in Orthopedics.