Kateryna Hronska and Kamran Zamanian, iData Research Inc.04.10.23

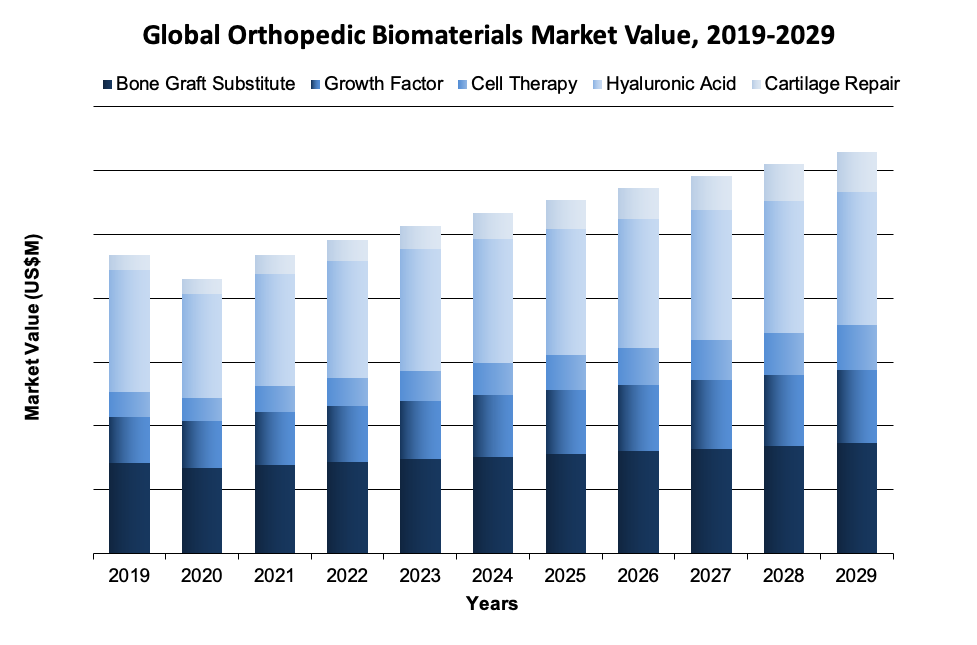

More than 5.4 million orthopedic procedures were performed worldwide in 2022 to manage bone and joint degenerative and inflammatory problems.4 Every year this number increases due to the rising prevalence of bone-related illness associated with the aging population. This article will discuss the main drivers for growth of one of the most popular types of orthopedic biomaterial used – bone grafts.

According to the World Health Organization, musculoskeletal conditions are the leading contributor to disability worldwide and affects approximately 1.7 billion people.2 Consequently, the need for affordable and effective intervention is essential to reduce morbidity associated with bone diseases. Therefore, companies have to be prepared to respond to the increasing demand for orthopedic biomaterials.

A number of major competitors in the orthopedic biomaterials market are benefiting from this market growth, along with newer competitors that are bringing novel technology into the market.

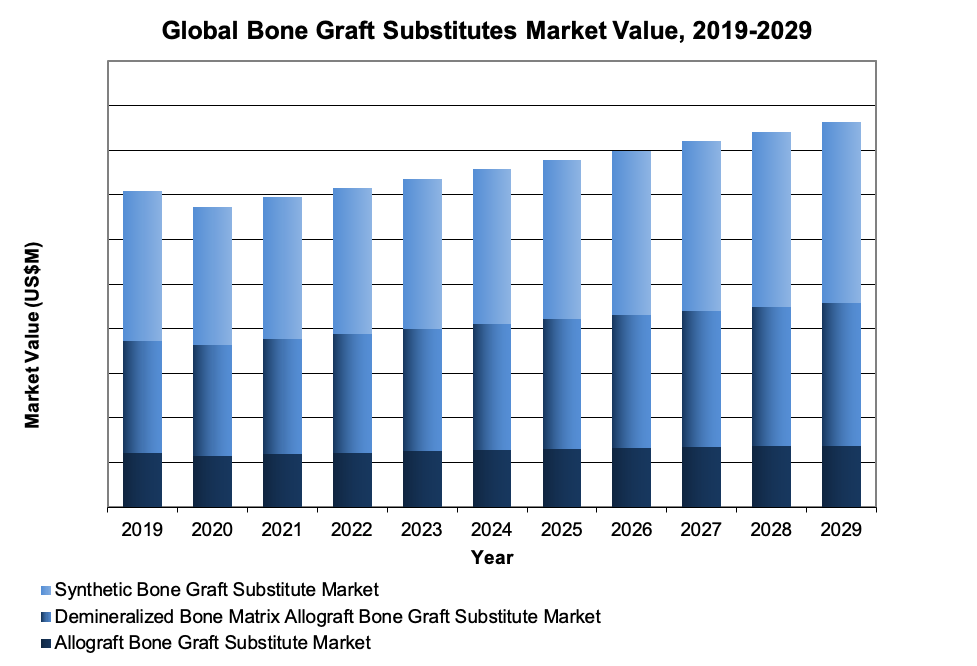

This market was one of the smallest in the overall bone graft substitute market in terms of market value. The decelerating growth in units sold can be attributed to budgetary constraints in hospitals. The average selling price of allografts is declining steadily, thus offsetting some of the rise in units sold. Due to their lower price, compared to bone graft substitutes of other materials, allografts are usually preferred for operations requiring a large amount of bone grafts.4 One of the main disadvantages is the risk of infection and the rejection of the transplanted bone graft by the recipient’s immune system.

DBMs without carriers are beginning to cannibalize the older, more traditional DBMs with carriers. This transition will help rejuvenate the DBM market going forward, ultimately delaying the decline of the ASP in this market segment, as DBMs without carriers are more expensive. However, this higher price point may cause some resistance to the transition to products without carriers or may introduce more pricing pressure as these newer products become more commonly used.

Like standard allograft bone grafts, DBM reduces or eliminates the need for autograft harvesting of bone. The product comes in many forms, including chips, granules and putties, but it is putties that are the most preferred for their handling properties. DBM tends to be used for instances in which the surgeon needs to fill an irregular space or surface and in which osteoinduction is preferable to osteoconduction. The demineralization process leaves the biologically active portion of bone more available, which improves osteoinduction at the expense of scaffolding, which, in turn, reduces the graft’s osteoconductive properties.

Also, synthetic grafts are often seen as safer than allografts. They pose no threat of disease transmission, and they cannot be rejected, as they are not made from foreign tissue. Also, they cause no unwarranted side effects from growth factors. On the other hand, the synthetic biomaterial does not have similar rates of resorption and properties as a biological bone. The use of synthetic products in the spine is expected to increase as prices for synthetic grafts decrease in the coming years.

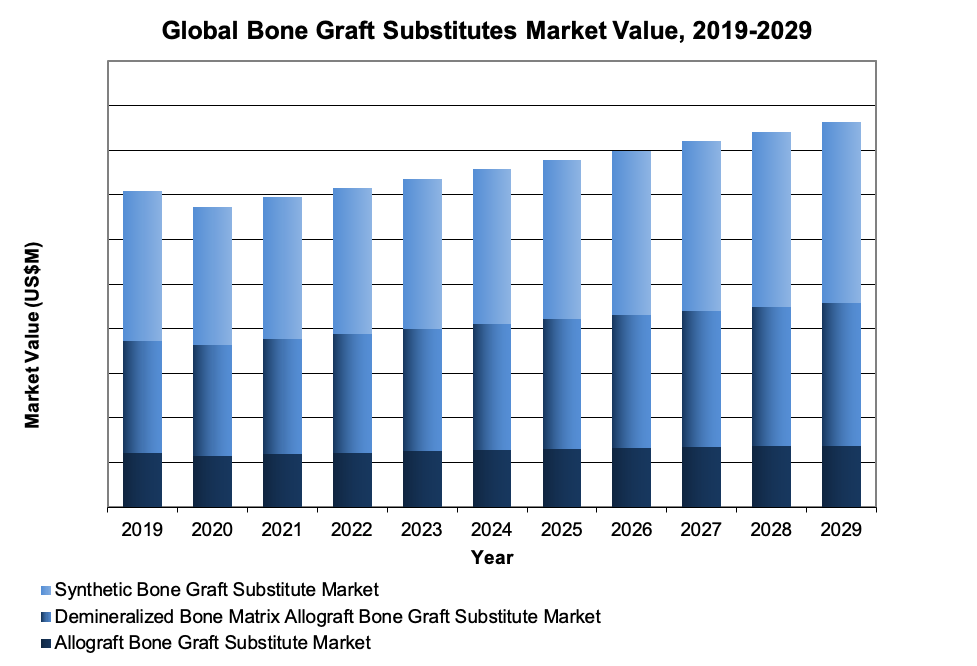

Additionally, the pairing of synthetics with biologically active products, which results in the removed risk of disease transfer while still providing biological benefits, will help push this growth even further. Synthetics have overtaken the demineralized bone matrix (DBM) market by market value and are projected to overtake DBMs in procedural volume in the upcoming years.4

The bone graft substitute market includes many competitors, particularly in the synthetic segment, where bone banks are not needed to supply the material and higher average selling prices provide greater incentive to penetrate this segment. With the acquisition of Wright Medical on November 11, 2020, Stryker has solidified its position with the second-largest share of the orthopedic bone graft substitute space, marginally behind the market leader, Medtronic. DePuy Synthes remained the third-leading player in this space.

Kateryna Hronska is a research analyst at iData Research. She works on research projects regarding the medical device industry, publishing the Global Orthopedic Biomaterials research report.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

References:

1. Mayo Foundation for Medical Education and Research. (2021, August 21). Osteoporosis. Mayo Clinic. Retrieved November 24, 2022, from https://www.mayoclinic.org/diseases-conditions/osteoporosis/symptoms-causes/syc-20351968

2. World Health Organization. (n.d.). Musculoskeletal health. World Health Organization. Retrieved November 24, 2022, from https://www.who.int/news-room/fact-sheets/detail/musculoskeletal-conditions

3. Bostrom, M. P. G., & Seigerman, D. A. (2005, September). The clinical use of allografts, demineralized bone matrices, synthetic bone graft substitutes and osteoinductive growth factors: A survey study. HSS journal : the musculoskeletal journal of Hospital for Special Surgery. Retrieved November 24, 2022, from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2504134/

4. iData Research Inc. Global Orthopedic Biomaterials Market – 2022. Published ___ 2022. Accessed ___, 2022.

Aging Population and Bone-Related Illness

Worldwide growth in orthopedic biomaterials can be attributed to the aging of the population. As a person ages, the bones become weak and brittle due to a variety of factors including but not limited to genetics, hormonal changes and dietary factors.1 Therefore, various types of bone disease are much more prevalent among patients over 55 years of age. Consequently, the aging of the population directly correlates with the increasing incidence rate of bone disease and the need to address it.According to the World Health Organization, musculoskeletal conditions are the leading contributor to disability worldwide and affects approximately 1.7 billion people.2 Consequently, the need for affordable and effective intervention is essential to reduce morbidity associated with bone diseases. Therefore, companies have to be prepared to respond to the increasing demand for orthopedic biomaterials.

A number of major competitors in the orthopedic biomaterials market are benefiting from this market growth, along with newer competitors that are bringing novel technology into the market.

Bone Graft Substitutes Variability

This article is focused on the analysis of different types of bone grafts, which might be of natural, synthetic or composite materials sources.Allografts

Allograft bone graft substitutes are procedures where the material is obtained from a living donor. Although this type of biomaterial has a variety of advantages, such as an abundance of materials and a decreased morbidity rate after the procedure, the method remains the least preferred by doctors in developed countries.This market was one of the smallest in the overall bone graft substitute market in terms of market value. The decelerating growth in units sold can be attributed to budgetary constraints in hospitals. The average selling price of allografts is declining steadily, thus offsetting some of the rise in units sold. Due to their lower price, compared to bone graft substitutes of other materials, allografts are usually preferred for operations requiring a large amount of bone grafts.4 One of the main disadvantages is the risk of infection and the rejection of the transplanted bone graft by the recipient’s immune system.

Demineralized

Demineralized bone matrix (DBM) is derived from an allograft bone by the process known as demineralization, which results in composite of proteins, growth factors and collagen.3 After this procedure, the manufacturers may add additional carries that help in the delivery of the product, including but not limited to sponges, putties, pastes or strips.3 The average selling price for DBM products is approximately double the price of allograft products.4 In particular, DBM is more expensive to produce than standard allograft chips because of the extra processing required in the demineralization process.DBMs without carriers are beginning to cannibalize the older, more traditional DBMs with carriers. This transition will help rejuvenate the DBM market going forward, ultimately delaying the decline of the ASP in this market segment, as DBMs without carriers are more expensive. However, this higher price point may cause some resistance to the transition to products without carriers or may introduce more pricing pressure as these newer products become more commonly used.

Like standard allograft bone grafts, DBM reduces or eliminates the need for autograft harvesting of bone. The product comes in many forms, including chips, granules and putties, but it is putties that are the most preferred for their handling properties. DBM tends to be used for instances in which the surgeon needs to fill an irregular space or surface and in which osteoinduction is preferable to osteoconduction. The demineralization process leaves the biologically active portion of bone more available, which improves osteoinduction at the expense of scaffolding, which, in turn, reduces the graft’s osteoconductive properties.

Synthetic

In 2022, the synthetic bone graft substitute market represented the largest segment of the bone graft substitute market in terms of market value.4 Synthetic bone graft substitutes are more expensive versions of the biomaterial compared to the allograft.4 Yet, despite the higher average selling price, this biomaterial is gaining popularity in the medical community due to its benefits.4 The main advantages of using synthetic bone grafts include unlimited supply and easy sterilization. As a result, it is a more accessible type of biomaterial that carries lower risks of infection to a patient.Also, synthetic grafts are often seen as safer than allografts. They pose no threat of disease transmission, and they cannot be rejected, as they are not made from foreign tissue. Also, they cause no unwarranted side effects from growth factors. On the other hand, the synthetic biomaterial does not have similar rates of resorption and properties as a biological bone. The use of synthetic products in the spine is expected to increase as prices for synthetic grafts decrease in the coming years.

Additionally, the pairing of synthetics with biologically active products, which results in the removed risk of disease transfer while still providing biological benefits, will help push this growth even further. Synthetics have overtaken the demineralized bone matrix (DBM) market by market value and are projected to overtake DBMs in procedural volume in the upcoming years.4

Closing Points

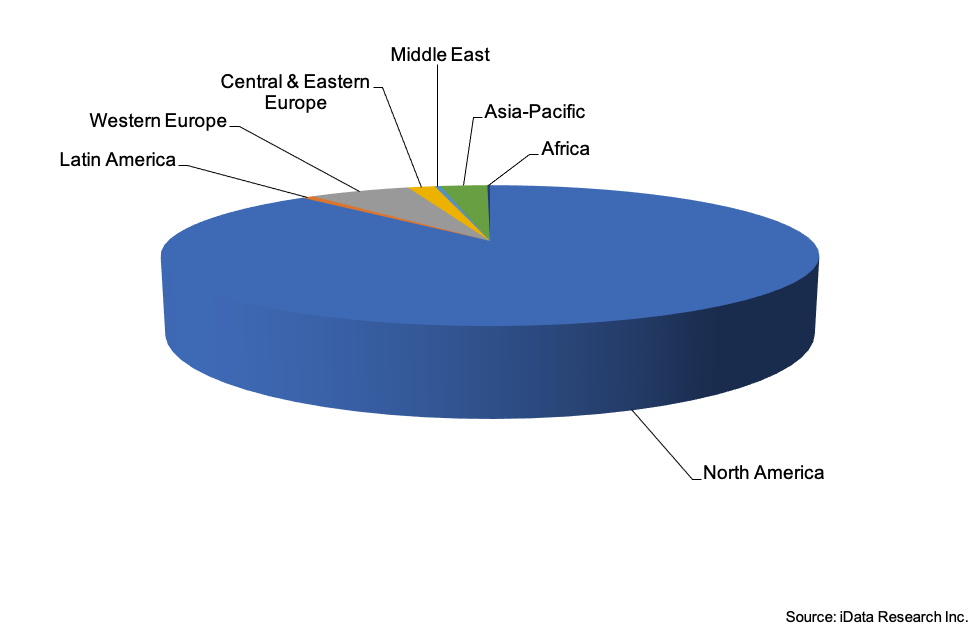

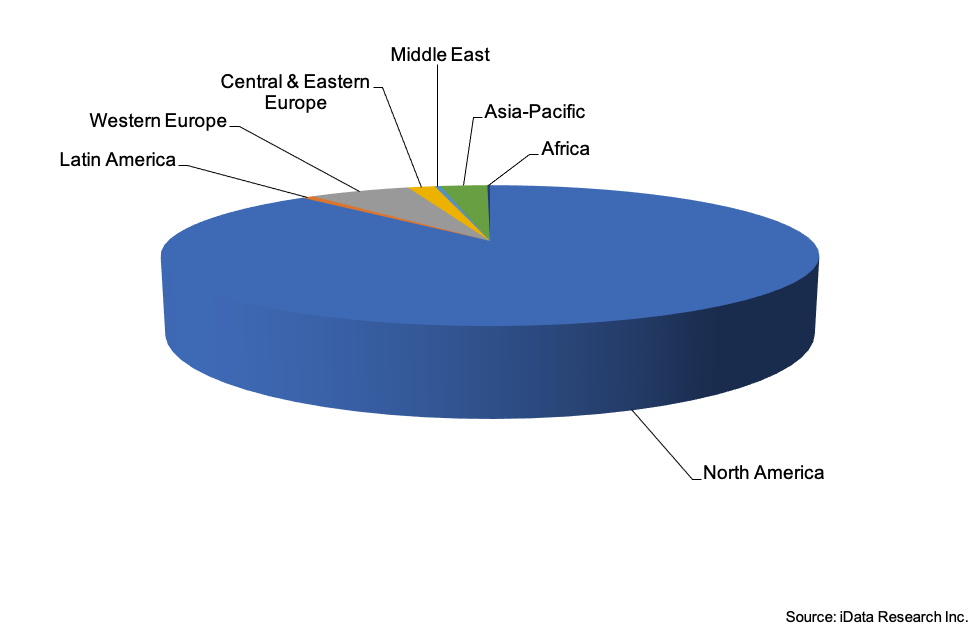

The global orthopedic biomaterials market has been evolving and growing dramatically in the past and it is expected to maintain growth as the needs of the population increase. With the high cost of most biomaterials, North America and Western Europe represent the highest percentage of the total market. Additionally, orthopedic biomaterials are slowly becoming more prevalent across the globe.The bone graft substitute market includes many competitors, particularly in the synthetic segment, where bone banks are not needed to supply the material and higher average selling prices provide greater incentive to penetrate this segment. With the acquisition of Wright Medical on November 11, 2020, Stryker has solidified its position with the second-largest share of the orthopedic bone graft substitute space, marginally behind the market leader, Medtronic. DePuy Synthes remained the third-leading player in this space.

Kateryna Hronska is a research analyst at iData Research. She works on research projects regarding the medical device industry, publishing the Global Orthopedic Biomaterials research report.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

References:

1. Mayo Foundation for Medical Education and Research. (2021, August 21). Osteoporosis. Mayo Clinic. Retrieved November 24, 2022, from https://www.mayoclinic.org/diseases-conditions/osteoporosis/symptoms-causes/syc-20351968

2. World Health Organization. (n.d.). Musculoskeletal health. World Health Organization. Retrieved November 24, 2022, from https://www.who.int/news-room/fact-sheets/detail/musculoskeletal-conditions

3. Bostrom, M. P. G., & Seigerman, D. A. (2005, September). The clinical use of allografts, demineralized bone matrices, synthetic bone graft substitutes and osteoinductive growth factors: A survey study. HSS journal : the musculoskeletal journal of Hospital for Special Surgery. Retrieved November 24, 2022, from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2504134/

4. iData Research Inc. Global Orthopedic Biomaterials Market – 2022. Published ___ 2022. Accessed ___, 2022.