GlobalData03.02.18

The global orthopedics market was valued at $52.8bn in 2017, driven primarily by the growth of the aging population. The market is set to grow to $66.2bn in 2023 at a steady compound annual growth rate (CAGR) of 3.8 percent, according to GlobalData, a data and analytics company.

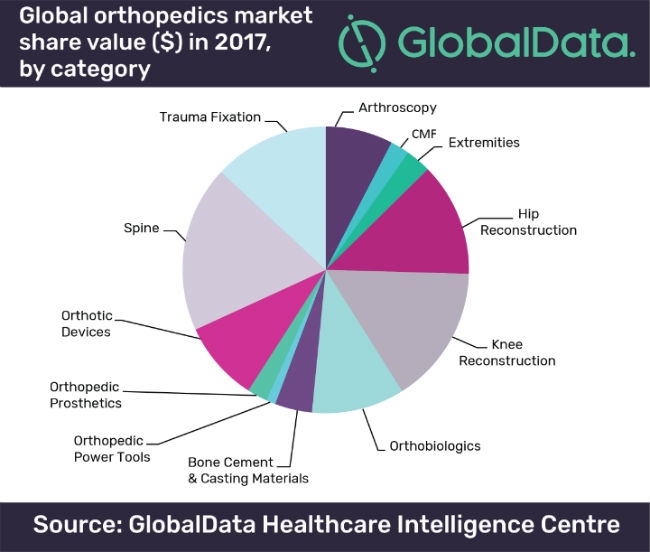

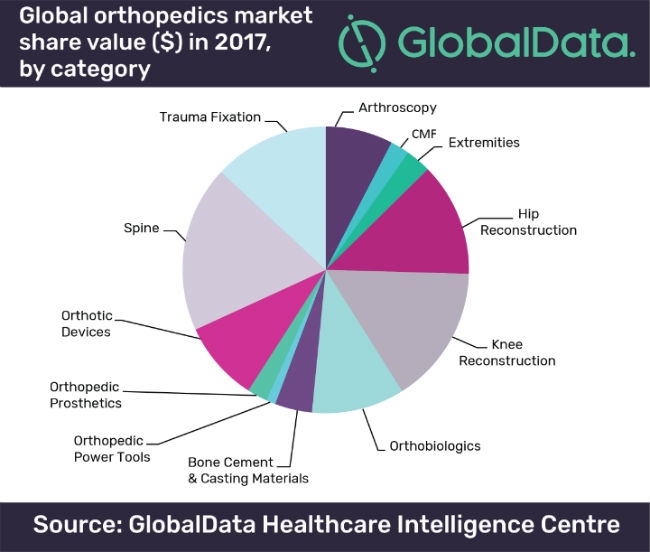

The orthopedics market consists of a number of device segments, including bone cement, surgical power tools, joint replacement implants and prosthetic limbs.

Jennifer Ryan, healthcare analyst at GlobalData, commented, ‘‘The largest market segments in 2017 were spine devices, hip and knee reconstruction implants, and trauma fixation. These markets are mature and established, with growth largely driven by the aging global population and subsequent increasing prevalence of diseases that primarily affect the elderly, including osteoarthritis and osteoporosis.’

However, the market segment expected to undergo the fastest growth is extremity implants, which is anticipated to grow at a CAGR of 6.2 percent through the forecast period.

Ryan continued, ‘‘This segment covers reconstructive implants for the small joints—ankle, digits, elbow, shoulder, and wrist—and is building on the established success of hip and knee implants. High growth in this area is powered by the increasing awareness of patients and physicians alike, of small joint implant options, and technological innovations contributing to more advanced implant designs. The forecast market for extremity implants will be propelled by shoulder and ankle replacement, which are projected to grow at CAGRs of 6.5 percent and 6.3 percent, respectively.’’

Artificial disc replacement is a growing trend worldwide, and Centinel Spine’s plans to expand the number of devices approved in the U.S. market will position the company well for international growth, as GlobalData anticipates the global artificial disc replacement market will grow at a speedy CAGR of 15.1 percent through to 2023.

Ryan added, ‘‘We anticipate that several areas will affect the orthopedics markets in 2018. Patient specific implants are expected to drive growth in the hip and knee markets, as is patient specific instrumentation (PSI), a tool developed to improve accuracy in total knee arthroplasty procedures by customizing the surgical cutting blocks to the patient’s anatomy.’’

Minimally invasive and robotic surgical systems are also a growing trend in orthopedic surgeries. Major orthopedic players such as Medtronic, Stryker, Smith & Nephew, and DePuy, are taking steps to ensure they remain competitive with their Mazor X, Mako, NAVIO, and PUREVUE systems, respectively.

Similarly, in the vein of personalized healthcare, 3D printing in a variety of orthopedic markets, including spinal interbodies, cranimaxillofacial implants, and prosthetic devices, will advance physicians’ ability to provide customized solutions to patients.

Lastly, a shift in the U.S. towards value-based healthcare, including Medicare’s Comprehensive Care for Joint Replacement (CJR) model, will continue to impact both orthopedic manufacturers and physicians, as will the move towards outpatient procedures in ambulatory surgical centers (ASCs).

The orthopedics market consists of a number of device segments, including bone cement, surgical power tools, joint replacement implants and prosthetic limbs.

Jennifer Ryan, healthcare analyst at GlobalData, commented, ‘‘The largest market segments in 2017 were spine devices, hip and knee reconstruction implants, and trauma fixation. These markets are mature and established, with growth largely driven by the aging global population and subsequent increasing prevalence of diseases that primarily affect the elderly, including osteoarthritis and osteoporosis.’

However, the market segment expected to undergo the fastest growth is extremity implants, which is anticipated to grow at a CAGR of 6.2 percent through the forecast period.

Ryan continued, ‘‘This segment covers reconstructive implants for the small joints—ankle, digits, elbow, shoulder, and wrist—and is building on the established success of hip and knee implants. High growth in this area is powered by the increasing awareness of patients and physicians alike, of small joint implant options, and technological innovations contributing to more advanced implant designs. The forecast market for extremity implants will be propelled by shoulder and ankle replacement, which are projected to grow at CAGRs of 6.5 percent and 6.3 percent, respectively.’’

Artificial disc replacement is a growing trend worldwide, and Centinel Spine’s plans to expand the number of devices approved in the U.S. market will position the company well for international growth, as GlobalData anticipates the global artificial disc replacement market will grow at a speedy CAGR of 15.1 percent through to 2023.

Ryan added, ‘‘We anticipate that several areas will affect the orthopedics markets in 2018. Patient specific implants are expected to drive growth in the hip and knee markets, as is patient specific instrumentation (PSI), a tool developed to improve accuracy in total knee arthroplasty procedures by customizing the surgical cutting blocks to the patient’s anatomy.’’

Minimally invasive and robotic surgical systems are also a growing trend in orthopedic surgeries. Major orthopedic players such as Medtronic, Stryker, Smith & Nephew, and DePuy, are taking steps to ensure they remain competitive with their Mazor X, Mako, NAVIO, and PUREVUE systems, respectively.

Similarly, in the vein of personalized healthcare, 3D printing in a variety of orthopedic markets, including spinal interbodies, cranimaxillofacial implants, and prosthetic devices, will advance physicians’ ability to provide customized solutions to patients.

Lastly, a shift in the U.S. towards value-based healthcare, including Medicare’s Comprehensive Care for Joint Replacement (CJR) model, will continue to impact both orthopedic manufacturers and physicians, as will the move towards outpatient procedures in ambulatory surgical centers (ASCs).