Maria Shepherd, President and Founder, Medi-Vantage09.14.21

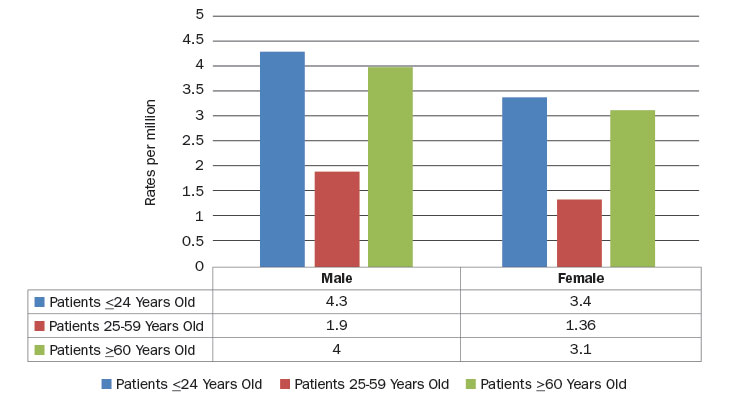

Sadly, U.S. osteosarcoma incidence rates peak in teenagers and the elderly.1,2 Using the Cancer Incidence in Five Continents (IARC database), the incidence rates for children and adolescents (ages 0-24), the 25-59-year-old group, and elderly (≥60) patients by world regions and individual countries were compared.3,4 Globally, osteosarcoma incidence rates were comparable for children and adolescents (Table 1). The greatest variation in incidence rates was observed in the elderly.

Why This Is Important

There are so many medical devices critical to the treatment of cancer. According to the World Health Organization, capital equipment (e.g., scopes, electrocardiography, infusion pumps, MRI, etc.) are vital tools in cancer management. So are laboratory diagnostics and pathology equipment, surgical equipment, PPE, shielding and radiation protection, imaging devices, medical furniture (like beds and IV poles), and of course, single-use medical devices. Medications such as chemotherapy and biosimilars, for those who can afford them, are also needed in the fight against cancer.

The Impact of COVID on Cancer

Experts are still estimating the extent of the COVID-19 pandemic’s impact around the world. Most agree, however, delays in diagnosis and treatment, patient fears of contracting COVID at a treatment facility, difficulties in gaining access to healthcare facilities due to closures or gatekeepers, and/or delayed or reduced access to screening programs are expected to cause a short-term decrease in reported cancer incidence. Further, it is predicted this period will be followed by an increase in late-stage diagnoses and cancer mortality in some areas of the world.

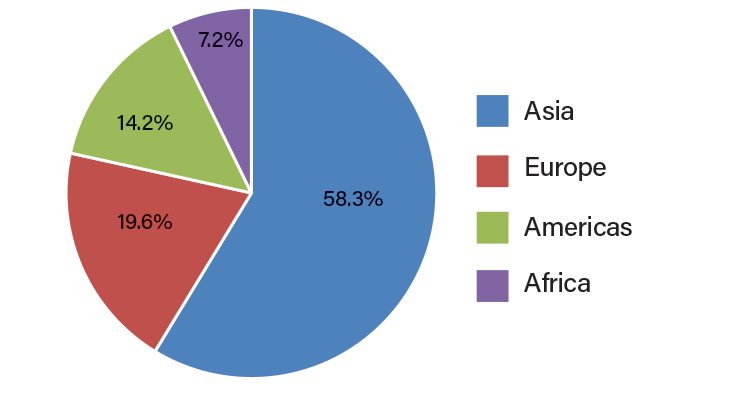

COVID notwithstanding, data are available for 2020. There were an approximated 19.3 million new diagnoses of cancer and almost 10 million cancer deaths across the globe in 2020. For men and women combined, approximately 50 percent of all cancer cases and 58.3 percent of cancer deaths were assessed to have occurred in Asia in 2020. This aligns with population estimates—an estimated 59.5 percent of the global population resides in that region. Europe reported 22.8 percent of total cancer cases and 19.6 percent of cancer deaths. These numbers do not align with population estimates in Europe—9.7 percent of the global population. In North America, the incidence is 20.9 percent with 14.2 percent of deaths worldwide (Table 2). Sadly, the percentage of cancer deaths in Asia (58.3 percent, as noted above) and Africa (7.2 percent) are greater than the incidence (49.3 percent and 5.7 percent, respectively), likely caused by the different types of cancer experienced there and higher case fatality rates in many of these underserved regions. For both sexes combined, the top 10 cancers account for >60 percent of the newly diagnosed cancer cases and >70 percent of the cancer deaths.5

Table 2: Global deaths from cancer by region in 2020.5

Bone Metastases

According to UpToDate, bone metastases are a common display of distant relapse from many forms of solid cancers, especially those arising in the breast, lung, and prostate, and are a prominent source of morbidity.6 Skeletal-related events (SREs) that are caused by bone metastases include pathologic fracture, pain, spinal cord compression, and hypercalcemia. Across the many types of tumors involving bone, the frequency of SREs can be reduced through the use of osteoclast inhibitors, such as bisphosphonates or Denosumab.

Management for patients with bone metastases include decreasing pain or symptom control, preserving and restoring function, minimizing the risk for SREs, stabilizing the skeleton (if needed), and enhancing local tumor control. Therapeutic options include pain management/analgesia (which may be administered in parallel with osteoclast inhibitors), systemic anticancer therapy, radiation therapy, stereotactic body radiation therapy, bone-targeting radiopharmaceuticals, surgery for patients with a complete or impending pathologic fracture, and image-guided thermal ablation.

Osteoclast inhibitors are indicated to manage metastatic bone disease for the majority of patients with solid tumors. Osteoclast inhibitors may slow or reverse the progression of bone metastases to reduce the occurrence of SREs. In addition, they also have modest analgesic benefit and are more frequently prescribed for the treatment of osteoporosis. In addition, in many clinical trials, Denosumab (a blockbuster drug from Amgen) proved moderately superior to bisphosphonates for the prevention of SREs and in providing an analgesic effect. However, the analgesic efficacy of these compounds is limited, and are not recommended as first-line pain-relieving agents to treat bone metastases.

In 2008, Amgen announced promising results for its experimental osteoporosis drug Denosumab. Their goal was to take market share from Fosamax, Merck’s popular small-molecule drug.7 In phase 3 trials, Denosumab showed positive outcomes by reducing the instance of spine fractures in postmenopausal women with osteoporosis by approximately 67 percent. Denosumab (trade name Prolia) will compete for a share of the market dominated by Merck that had estimated revenues of nearly $2 billion in 2007.

Adjust Sales and Product Development Strategies

A very small number of highly successful products signify the top-heavy shape of the oncology drug market. The blockbusters are the first place to look for opportunities in medical devices. However, there are 28 other indications for blockbusters between $1 billion and $5 billion (where Prolia and Fosamax sit), providing another place to look for opportunity.

The Medi-Vantage Perspective

Strategy, strategy, strategy. Sometimes medtech innovators need to look under the most unlikely rocks to find strategic opportunity. Looking at pharma and biotech sales, especially in the highly valuable domains of oncology drugs, is one of many to start looking for opportunity.

References

Maria Shepherd has more than 20 years of leadership experience in medical device/life-science marketing in small startups and top-tier companies. After her industry career, including her role as vice president of marketing for Oridion Medical, where she boosted the company valuation prior to its acquisition by Medtronic, director of marketing for Philips Medical, and senior management roles at Boston Scientific Corp., she founded Medi-Vantage. Medi-Vantage provides marketing and business strategy and innovation research for the medical device industry. The firm quantitatively and qualitatively sizes and segments opportunities, evaluates new technologies, provides marketing services, and assesses prospective acquisitions. Shepherd has taught marketing and product development courses, speaks regularly at medtech conferences, and can be reached at mshepherd@medi-vantage.com. Visit her website at www.medi-vantage.com.

Why This Is Important

There are so many medical devices critical to the treatment of cancer. According to the World Health Organization, capital equipment (e.g., scopes, electrocardiography, infusion pumps, MRI, etc.) are vital tools in cancer management. So are laboratory diagnostics and pathology equipment, surgical equipment, PPE, shielding and radiation protection, imaging devices, medical furniture (like beds and IV poles), and of course, single-use medical devices. Medications such as chemotherapy and biosimilars, for those who can afford them, are also needed in the fight against cancer.

The Impact of COVID on Cancer

Experts are still estimating the extent of the COVID-19 pandemic’s impact around the world. Most agree, however, delays in diagnosis and treatment, patient fears of contracting COVID at a treatment facility, difficulties in gaining access to healthcare facilities due to closures or gatekeepers, and/or delayed or reduced access to screening programs are expected to cause a short-term decrease in reported cancer incidence. Further, it is predicted this period will be followed by an increase in late-stage diagnoses and cancer mortality in some areas of the world.

COVID notwithstanding, data are available for 2020. There were an approximated 19.3 million new diagnoses of cancer and almost 10 million cancer deaths across the globe in 2020. For men and women combined, approximately 50 percent of all cancer cases and 58.3 percent of cancer deaths were assessed to have occurred in Asia in 2020. This aligns with population estimates—an estimated 59.5 percent of the global population resides in that region. Europe reported 22.8 percent of total cancer cases and 19.6 percent of cancer deaths. These numbers do not align with population estimates in Europe—9.7 percent of the global population. In North America, the incidence is 20.9 percent with 14.2 percent of deaths worldwide (Table 2). Sadly, the percentage of cancer deaths in Asia (58.3 percent, as noted above) and Africa (7.2 percent) are greater than the incidence (49.3 percent and 5.7 percent, respectively), likely caused by the different types of cancer experienced there and higher case fatality rates in many of these underserved regions. For both sexes combined, the top 10 cancers account for >60 percent of the newly diagnosed cancer cases and >70 percent of the cancer deaths.5

Table 2: Global deaths from cancer by region in 2020.5

Bone Metastases

According to UpToDate, bone metastases are a common display of distant relapse from many forms of solid cancers, especially those arising in the breast, lung, and prostate, and are a prominent source of morbidity.6 Skeletal-related events (SREs) that are caused by bone metastases include pathologic fracture, pain, spinal cord compression, and hypercalcemia. Across the many types of tumors involving bone, the frequency of SREs can be reduced through the use of osteoclast inhibitors, such as bisphosphonates or Denosumab.

Management for patients with bone metastases include decreasing pain or symptom control, preserving and restoring function, minimizing the risk for SREs, stabilizing the skeleton (if needed), and enhancing local tumor control. Therapeutic options include pain management/analgesia (which may be administered in parallel with osteoclast inhibitors), systemic anticancer therapy, radiation therapy, stereotactic body radiation therapy, bone-targeting radiopharmaceuticals, surgery for patients with a complete or impending pathologic fracture, and image-guided thermal ablation.

Osteoclast inhibitors are indicated to manage metastatic bone disease for the majority of patients with solid tumors. Osteoclast inhibitors may slow or reverse the progression of bone metastases to reduce the occurrence of SREs. In addition, they also have modest analgesic benefit and are more frequently prescribed for the treatment of osteoporosis. In addition, in many clinical trials, Denosumab (a blockbuster drug from Amgen) proved moderately superior to bisphosphonates for the prevention of SREs and in providing an analgesic effect. However, the analgesic efficacy of these compounds is limited, and are not recommended as first-line pain-relieving agents to treat bone metastases.

In 2008, Amgen announced promising results for its experimental osteoporosis drug Denosumab. Their goal was to take market share from Fosamax, Merck’s popular small-molecule drug.7 In phase 3 trials, Denosumab showed positive outcomes by reducing the instance of spine fractures in postmenopausal women with osteoporosis by approximately 67 percent. Denosumab (trade name Prolia) will compete for a share of the market dominated by Merck that had estimated revenues of nearly $2 billion in 2007.

Adjust Sales and Product Development Strategies

A very small number of highly successful products signify the top-heavy shape of the oncology drug market. The blockbusters are the first place to look for opportunities in medical devices. However, there are 28 other indications for blockbusters between $1 billion and $5 billion (where Prolia and Fosamax sit), providing another place to look for opportunity.

The Medi-Vantage Perspective

Strategy, strategy, strategy. Sometimes medtech innovators need to look under the most unlikely rocks to find strategic opportunity. Looking at pharma and biotech sales, especially in the highly valuable domains of oncology drugs, is one of many to start looking for opportunity.

References

- bit.ly/odt210901

- bit.ly/odt210902

- Mascarenhas, L.; Siegel, S.; Spector, L.; Arndt, C.; Femino, D.; Malogolowkin, M. Malignant bone tumors: cancer in 15- to 29-year-olds in the United States. In: Bleyer, A.; O'Leary, M.; Barr, R.; Ries, LAG., editors. Cancer Epidemiology in older adolescents and young adults 15 to 29 years of age, including SEER incidence and survival: 1975–2000. Bethesda, MD: National Cancer Institute; 2006. p. 98-109.NIH Pub. No. 06-5767

- Parkin, DM.; Kramárová, E.; Draper, GJ.; Masuyer, E.; Michaelis, J.; Neglia, J.; Qureshi, S.; Stiller, CA. IARC Scientific Publications No. 144. Vol. vol. 2. Lyon: 1998. International incidence of childhood cancer

- bit.ly/odt210905

- bit.ly/odt210906

- bit.ly/odt210907

Maria Shepherd has more than 20 years of leadership experience in medical device/life-science marketing in small startups and top-tier companies. After her industry career, including her role as vice president of marketing for Oridion Medical, where she boosted the company valuation prior to its acquisition by Medtronic, director of marketing for Philips Medical, and senior management roles at Boston Scientific Corp., she founded Medi-Vantage. Medi-Vantage provides marketing and business strategy and innovation research for the medical device industry. The firm quantitatively and qualitatively sizes and segments opportunities, evaluates new technologies, provides marketing services, and assesses prospective acquisitions. Shepherd has taught marketing and product development courses, speaks regularly at medtech conferences, and can be reached at mshepherd@medi-vantage.com. Visit her website at www.medi-vantage.com.